Following its rise to a record high of $99,588, Bitcoin (BTC) holds firm above $97,700. The cryptocurrency has struggled to rally since last being up 9 percent last week, sticking to $97,600 on Monday. Experts see BTC breaking past the psychologically important $100,000 mark if the upward mobility continues.

On the other hand, Ethereum (ETH) is close to breaking its weekly resistance and could continue. Ripple (XRP) is holding firm at a key support level and continues its bullish trend.

With market optimism on the rise, Bitcoin’s chances to breach the $100,000 threshold and put a new ceiling in the crypto market are all anyone is talking about.

According to analysts, however, if Bitcoin (BTC) bears out, it could test out the psychological support level of $90,000. Technical indicators like the Relative Strength Index (RSI) give me something to be concerned about, as it starts showing overbought and could head for a correction.

BTC Faces Resistance Below $100K

But over the weekend, Bitcoin’s push above the $100,000 mark faced tough resistance, with BTC/USD failing to pierce through the noise of a resurgence of order book ‘spoofing’ activity at exchanges.

They had resurfaced large ask liquidity walls strategically placed to sink the market to key support levels. Skew’s data showed huge bid liquidity at $95,000, with $97,300 as the ‘pivotal low’ in recent trading.

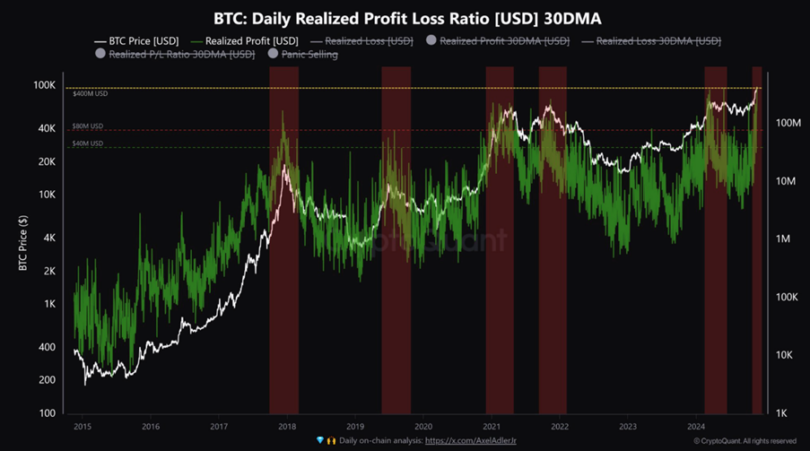

At the same time, long-term Bitcoin holders were able to cash in on the recent price surge, making record profits on November 22 as Bitcoin touched its all-time high of $99,800. According to analyst Maartunn, on the chain analytics platform CryptoQuant, sellers had a bonanza on the day, realizing no less than $443 million in profits.

Analyst Reiterates $175,000 Price Target

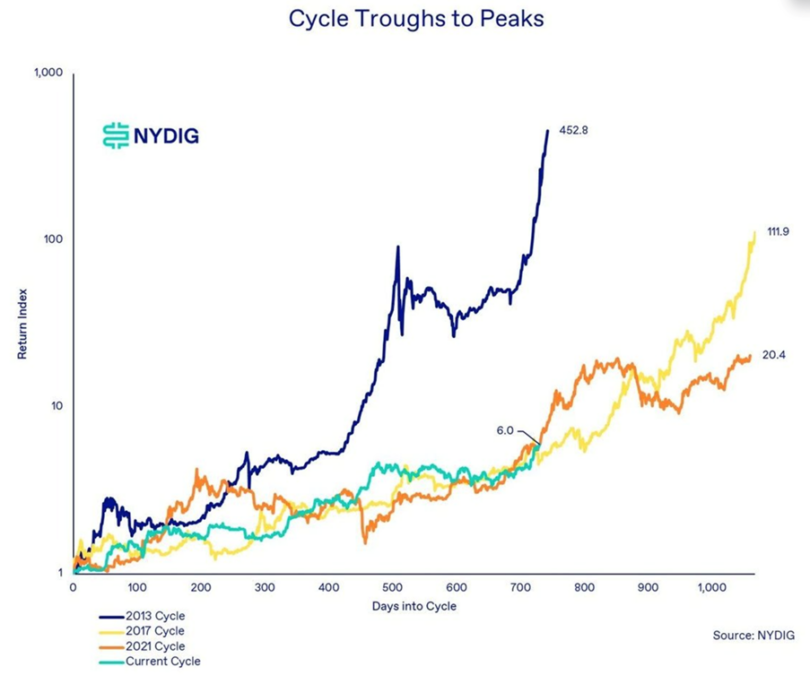

Analysts forecast a bullish outlook on Bitcoin despite its near-term resistance. The optimism came from financial research platform Cubic Analytics founder Caleb Franzen, who noted Bitcoin’s nearly 50% gains in Q4 as a base for continued upward momentum.

Repeatedly reaffirming his ambition of a $175,000 price point, Franzen emphasized the bullishness of the broader market on Bitcoin’s long-term prospects.

Financial analyst Caleb Franzen warned that Bitcoin may not reach its $175,000 price target by the end of 2025, but he hasn’t yet swayed from his new $175,000 target. Letting his voice be heard on the current Bitcoin bull market, Franzen described it as “right on schedule” and his confidence in the cryptocurrency’s long-term growth trajectory.

Franzen used a comparative chart that compared this year’s bull market performance to past Bitcoin cycles to support his projection into the future of Bitcoin.

Ethereum Price Update

Last week, Ethereum performed quite well, rallying up to $3,000 in support and gaining 9.27%. The cryptocurrency, trading at roughly $3,336 Monday, is approaching its weekly resistance at about $3,454.

If Ethereum is able to smash and hold firm above the $3,454 resistance level, it can lead to a further upswing of 16% or more, hitting the psychological $4,000 figure.

Further, technical indicators indicate that bullish momentum is strengthening, with the daily Relative Strength Index (RSI) reading at 65 above the neutral level of 50.

However, on the negative side, a failure of Ethereum to gain a close above the $3,454 weekly resistance level may lead to an upside scenario for the token. If Bitcoin closes below $3,330, it could be a sign of a potential pullback, with the cryptocurrency retesting its critical support area at around $3,000.

During the period under review, Ethereum’s price had a low of $3,262 and a high of $3,428. While gentle, ETH gained 7% over the past week, proving its stamina. Ethereum’s market capitalization is heavy at $400 billion, placing it 12th in the crypto market.

Ethereum’s futures open interest has been surging and its funding rates are positive, fueled by bullish investor sentiment towards ETH.

An increasing number of traders are betting on further price gains for ETH, which could send the price upward on momentum. But the heightened demand is largely driven by rising leverage and optimistic market sentiment, suggesting more room to run on prices.

Ethereum Futures Market Growth

Ethereum futures market went up and reinforced the bullish outlook. The total number of active futures contracts, measured by open interest, rose to a record $20.8 billion, up 12%. Ethereum’s 7.31% price rise over the past week suggests the uptick here suggests elevated trader participation.

Along with the surge in open interest, this passes as confidence, especially among those taking long positions to trade on the prospect of higher prices. If this sentiment holds, Ethereum’s futures funding rate has hit an all-time high of 0.0374%, suggesting the market anticipates continued price rises.

Ethereum’s leverage ratio has reached a new peak of 0.40, another key indicator. This increase reflects an increase in how much traders are willing to borrow to enhance their positions, a measure of potentially taking on more risk for larger profits.

Ethereum’s futures market has grown by more than 40% over the past few months, climbing past the $20 billion threshold for the first time. This shows a real surge in investors’ interest and optimism in Ethereum’s potential.

When sentiment turns positive, when more traders put a bet in on a price increase, the demand that would come into play would fuel sustained upward momentum in the market, and ETH’s price could go up.

Ethereum Surges to $3,500 Amid Record Staking Inflows

During the month, the demand for Ethereum (ETH) has skyrocketed, pushing the coin’s price to $3,500, a price milestone not achieved since the start of summer.

Ethereum has remained in the shadow of Bitcoin (BTC), which sustained a 34% monthly gain, despite an inability to get pace with the altcoin hitting more than five record highs in just a week. ETH has rocketed up after seven days, rising sharply from the low of $3,031 to the $3,500 mark.

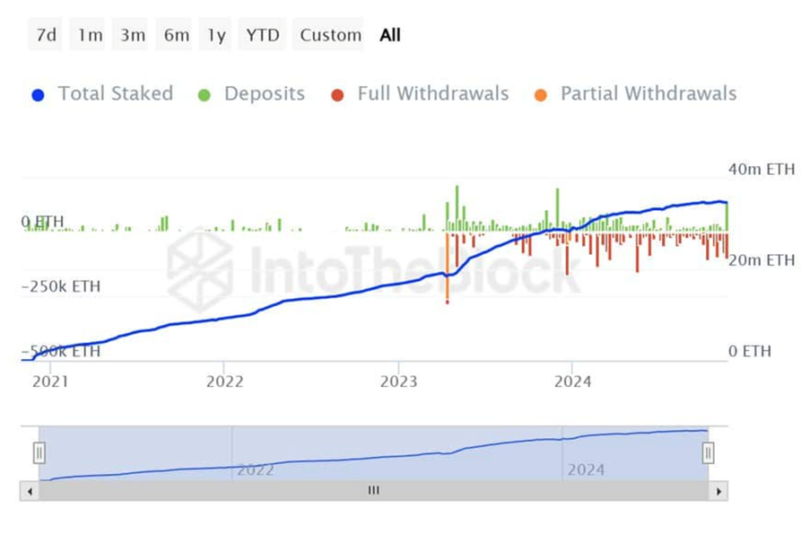

Coinciding with the record-breaking inflows into Ethereum 2 staking, this price rally. Blockchain analyst Maartunn says that ETH’s weekly netflow has never been this high. This is corroborated by data from IntoTheBlock, which records a +10,000 ETH netflow per week. Over this period, 115,000 more ETH were staked in the pool, while 105,000 removed them.

There has been a notable shift in Ethereum’s market dynamics, as deposits have long lagged behind withdrawals in recent months. Analysts are crediting this reversal to a combination of factors, such as rising ETH prices and staking infrastructure developments.

Reducing the circulating ETH supply is significant for Ethereum’s ecosystem as staking activity surged. Generally, healthy conditions for price appreciation find their root in a lower supply and a heightened demand.

Secondly, Maartunn underlines that this is not just about Ethereum, as it makes Ethereum’s inflation control mechanisms and long-term future growth prospects even more solid. Only a bullish signal for the future value of Ethereum (and the health of the whole ecosystem) can the recent influx of staked ETH be considered.

Ripple Price Positioned for Potential Rally Amid Robust Weekly Support

Strong weekly support holds firm, and Ripple (XRP) appears ready for another upward push. The cryptocurrency found a solid base around the $1.40 level on Monday, trading about $1.45 higher. It’s a sharp rally after an impressive 36% rally the previous week, piling on for a continuation.

If XRP can maintain support at $1.40, the token could return to the three-year peak of $1.96 last seen in April 2021, say market analysts. This prospect has lured traders eyeing the next potential breakout.

However, concerns over risk abound. Currently, the Relative Strength Index is at an overbought level of 86. However, this metric gives us cause for concern in the form of an overextended RSI that usually precedes a price pullback. Therefore, traders are advised to stick to long positions and take their spreads if and only if they see clearer signals as the RSI exits overbought territory.

If the XRP pullbacks, there’s a prime psychological support level at $1.00 that it would like to test to act as an important point on the way to spot traders looking to navigate short-term volatility.