Bitcoin (BTC) is retreating slightly from recent weekly highs after posting a 4.47% drop by Wednesday’s session, but it continues to display indecision by edging higher at around $98,400. Investors have been split on the cryptocurrency, with optimism from institutional adoption and heartburn from corporate outcomes.

Bitcoin tumbled to $94,150 on Monday before stabilising. The decline was blamed on long positions in BTC going from over-leveraged to unwinding back to the $100,000 level, triggering a large liquidation cascade and writing a K33 report.

The company’s shareholders voted down a proposal to include Bitcoin on Microsoft’s balance sheet Tuesday, adding to the pressure. Last week, Microsoft’s board pitched the idea to Michael Saylor, chief executive of MicroStrategy, who said Bitcoin investments could help the tech giant’s financial strategy. However, the board rejected the proposal, classifying Bitcoin as an ‘unnecessary risk’ out of whack with Microsoft’s core strategy.

Stirring fear in the crypto community, Google announced its ‘Willow’, its advanced quantum chip. Chips’ capabilities raised alarms about Bitcoin encryption protocols at risk from the chips. It reignited a debate about the dire need for quantum-resistant technology protecting blockchain networks.

Despite these difficulties, Bitcoin interest among institutions remains strong. Tuesday saw a second consecutive day of large inflows into Bitcoin Spot Exchange Traded Funds (ETFs), which Coinglass reported at $438.90 million. However, sustained demand at this level could propel Bitcoin’s price recovery towards the upside.

Marathon Digital added to the bullish sentiment. On Tuesday, it announced it had purchased 11,774 BTC for $1.1 billion at an average price of $96,000 per Bitcoin. That gives the mining company a total of 40,435 BTC, worth around $3.9 billion, suggesting that the company is confident in Bitcoin’s long-term potential.

Investor doubt remains, but Bitcoin’s strong institutional backing and continued growth in holdings by key players such as Marathon Digital and Riot Platforms show faith is enduring.

During the same period, Marathon Digital announced it had acquired 11,774 BTC at $1.1 billion at an average of $96,000 BTC each. Thus, the company’s total Bitcoin holdings have been increased to 40,435 BTC ($3.9 billion).

According to data from Lookonchain, Riot Platforms bought 705 BTC for $68.45 million on Wednesday. The news comes after the company announced a $500 million private offering of convertible senior notes on Monday, intended for Bitcoin-related acquisitions and broader corporate use. Market analysts say this could signal a price recovery if institutional demand for Bitcoin continues.

Meanwhile, Bitcoin MENA and Abu Dhabi Financial Conferences saw several developments regarding support for Bitcoin, such as Ray Dalio, founder of Bridgewater Associates, offering support for the asset.

Bitcoin Price Forecast: BTC Faces Bearish Signals Amid Decline

As of Tuesday, Bitcoin’s price has dropped 4.47% this week, currently at around $98,400. Technical indicators signal a downturn into bullish momentum, with market analysts pointing to potential risks.

Although Bitcoin’s price recovered from mid-November, the price trend is still downward, and the relative strength index (RSI) on the daily chart signals concern. The RSI sits around the 60 mark, but if the daily closes below the neutral threshold of 50, it would confirm a takeover by bears.

Now, key Support and resistance levels are in focus. Losses will accelerate if a sustained drop towards the critical $90,000 support level and downward to $85,000 continues. Positive in this case is a move north of $104,088, which could find extra steam to the all-time high of $119,510, the 141.4% Fibonacci extension based on the November 4 $66,835 bottom.

As sentiment in the market shifts, market sentiment, traders should pay particular attention to these pivotal levels.

Ethereum Faces Market Dip

On Tuesday, the price of Ethereum (ETH) jumped as much as 0.9 per cent but saw a slight decline due to rising geopolitical risks following Israel’s reported attack on Syria’s navy. Investor caution sparked by the offensive, which, according to lawyers,s was meant to destroy chemical weapon stockpiles, has led some to de-risk their portfolios.

But market analysts say the sell-off could be temporary. CryptoQuant data indicates Ethereum’s accumulation addresses, which have inflows without outflows, have steadily increased to 19.5 million ETH, a new high. Such confidence among the long-term holders also rebounds comfortably, even in the face of short-term market fluctuations.

According to Coinglass data, $149.8 million flowed into US spot Ethereum exchange-traded funds (ETFs) on Monday (11 days in a row of flows). The inflows show that large-scale investors are keeping a bullish outlook after ETH’s price dip.

Ethereum researcher Max Resnick has left Consensys subsidiary Special Mechanisms Group to join Solana’s research firm, Anza. Taking his talents to Solana, according to an X post on December 9, Resnick is now a vocal critic of Ethereum’s Layer 2 scaling strategies.

Geopolitical uncertainties continue to affect short-term market dynamics, and Ethereum’s on-chain metrics and institutional backing could point to an imminent recovery.

Ethereum Price Analysis

Ethereum has dropped below 1% over the past 24 hours and liquidated $141.34 million. Long positions provided $113.30 million, while short liquidations were $28.04 million.

The cryptocurrency has reached the $3,550 mark and has been tested repeatedly over the last few weeks. This level sets a potential rally if the recovery is successful, bringing it to its yearly high resistance of $4,093.

Ethereum went on sale hard Friday after hitting the $4,093 resistance. For example, analysts believe this weakness may mean an attempt to push past this barrier may be revived. However, if the $3,550 support level breaks, ETH’s next important target would be $3,252.

Additionally, bearish technical indicators point to further declines. This adds evidence that the prevailing downward pressure breaks the Relative Strength Index (RSI) below its neutral threshold.

If Ethereum’s candlestick closes below the $3,252 mark, market analysts note that the coin’s bullish outlook would be invalidated, causing a dramatic change in its technical market.

Ripple Receives NYDFS Approval for RLUSD Stablecoin Amid XRP Jumps 7%

In a post on X on Tuesday, Ripple CEO Brad Garlinghouse announced that the company has received approval from the New York Department of Financial Services (NYDFS) to launch its RLUSD stablecoin. Ripple’s stablecoin initiative has been granted the regulatory greenlight, which will bring to fruition the debut of RLUSD on major exchanges. This is a massive milestone.

RLUSD maintains a 1:1. It has been designed to compete with the leading stable coins like USDT and USDC, pegged to the US dollar at 1 peg. Ripple claims RLUSD will be backed up by US dollar deposits, short-term government treasuries, and other cash equivalent to maintaining its stability and reliability.

Ripple introduced the stablecoin in April and beta-tested it on the XRP Ledger and Ethereum blockchain platforms in August. By October, Ripple announced that the exchange partners, including major exchanges such as Uphold, Bitstamp, Bitso, MoonPay, Independent Reserve, CoinMENA, and Bullish, will launch the RLUSD exchange.

Market makers B2C2 and Keyrock will provide liquidity support to the stablecoin, helping it be available and functional to the rest of the market.

According to crypto analysts, introducing RLUSD could generate massive momentum for XRP. Stablecoin, being less volatile, will strengthen Ripple’s remittance and settlement services and accelerate the adoption of its ecosystem.

The news was immediately reflected in XRP. The token rocketed over 7% to return from a low of $1.90. The rise comes from a long decline attributed to large holders’ selling pressure.

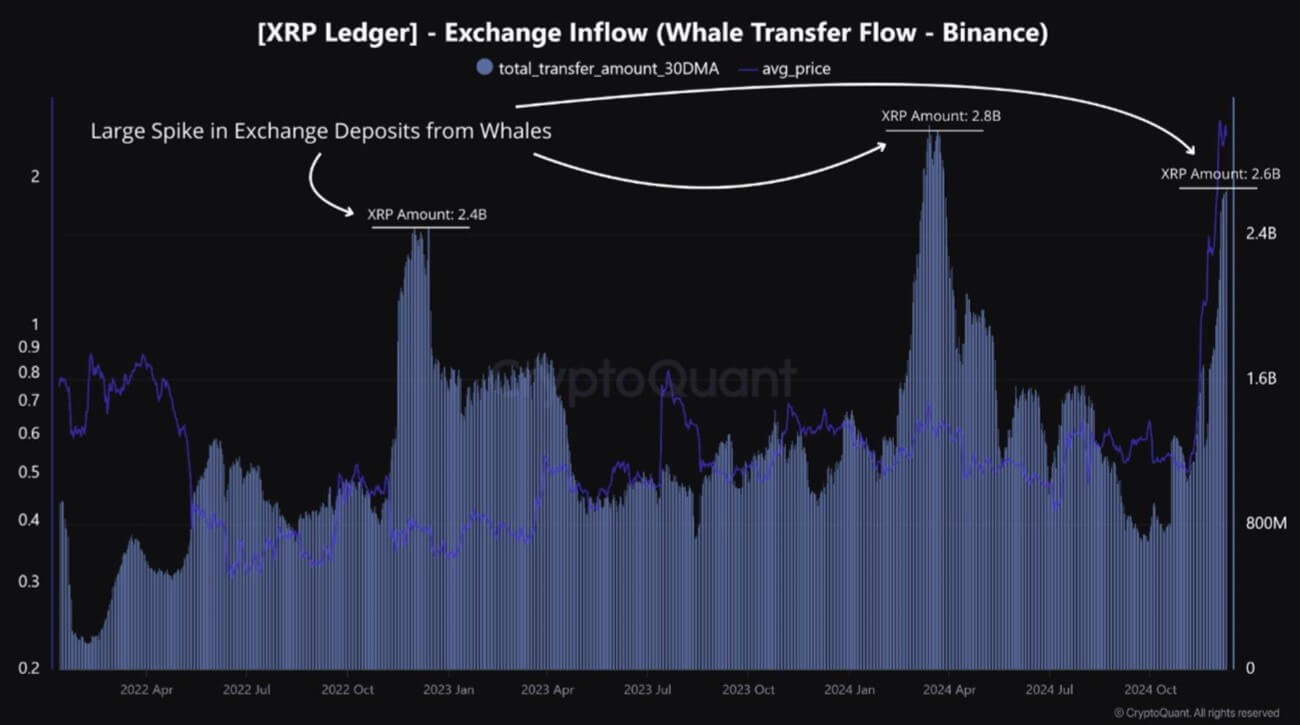

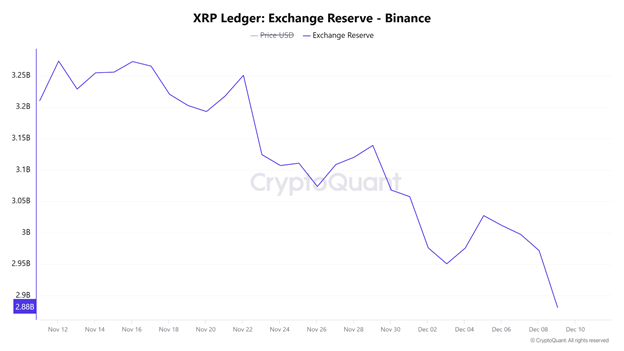

According to the blockchain analytics platform CryptoQuant, the value of 2.66 billion XRP tokens moved by whales to the Binance coin exchange last month has been the highest since April of this year. This has fueled speculation that potential sell-offs might be coming, but it did nothing to dampen market enthusiasm for RLUSD approval.

Once it goes live, Ripple’s issuance of a crypto asset like RLUSD could pave the way for its regulatory breakthrough with the NYDFS, making it a strong contender in the stablecoin market.

Ripple Price Analysis: XRP Eyes $3 Mark Amid $50M in Liquidations

Suppose XRP’s recent recovery trend holds strong. In that case, it may retest the critical $3 psychological level after a sharp rise, a sharp rally and a lot of liquidation activity over the past 24 hours. Data from Coinglass shows that the long position liquidated over $30 million of XRP, while the short position liquidated $18.97 million.

After testing the support level close to $1.96, cryptocurrency came sharply back in favour as the price shot above the 23.6% Fibonacci Retracement. XRP’s current uptrend could allow it to reclaim support at $2.58 before taking on the barricade at $3, setting a price benchmark previously clogged by the firms’ resistance.

The rally will resume if XRP fails to hold support above $1.96. Technical indicators suggest the road ahead may only be smooth. The Relative Strength Index (RSI) and Awesome Oscillator have each crossed above neutral thresholds but are beginning to dip, indicating a softening in the bullish momentum.

Market analysts warn that the bullish outlook would be invalidated if a daily candlestick close below $1.35 could trigger further declines.

As traders watch its upward path, XRP’s success or failure at grabbing $3 could determine its next move.