Crypto Market Analysis: BTC Holds Above $100,000 Amid US Government Moves While XRP's All-Time High in Sight

Bitcoin (BTC) traded at approximately $103,000 on Thursday, following a mild correction the previous day. Market sentiment turned cautious after the United States government moved 10,000 BTC, valued at $962.88 million, from a Silk Road-seized wallet to Coinbase Prime.

Olivier Mammet, Head of US OTC Trading at Gemini, provided insights into the potential short-to-medium-term price influences.

After declining during the Asian session, Bitcoin partially recovered during Tuesday’s early New York session. After a slight dip on Monday, it was trading near $95,900. If the downward trend persists, Bitcoin could face a short-term drop toward $90,000, especially as the US government moves significant BTC holdings to the exchange.

Data from the crypto intelligence tracker Arkham reveals that a wallet associated with the US government transferred 10,000 BTC from the Silk Road seizure address to Coinbase Prime on Monday.

Such a large-scale transfer to an exchange, particularly Coinbase Prime, often signals intentions to sell or distribute the assets, which can trigger bearish sentiment as market participants anticipate increased supply.

Traders are advised to remain cautious, recalling the US government’s sale of 29,799 BTC on July 29, which caused a sharp price drop. Bitcoin lost over 20% of its value within a week after the sale, with similar large-scale government transactions typically exerting significant selling pressure.

Despite these concerns, QCP’s report on Tuesday emphasized continued optimism, particularly regarding institutional demand. The hope remains that the incoming political party in the White House, the Securities and Exchange Commission (SEC), and the Department of Treasury will introduce regulations that foster the growth of the cryptocurrency industry.

Bitcoin Price Forecast: Potential Correction Toward $90K

Last week, Bitcoin suffered a correction, but shortly after the early Monday session, the price slightly declined. The cryptocurrency trades around $103,000 as of Thursday. A pullback will test Bitcoin’s $90,000 support level.

The Relative Strength Indicator (RSI) on the daily chart is 61 and rejects from the overbought area at 70, while the indicator points downward. It shows weak bullish momentum. The Moving Average Convergence, another technical indicator, is also used.

On November 26, the divergence (MACD) indicator went bearish, meaning that it could show selling pressure. The recent rising red histogram bars above the neutral zero line with the MACD also suggest that Bitcoin’s price could now have lower or downward momentum.

However, if Bitcoin (BTC) continues its upward movement, it may reach its all-time high (ATC) of $99,588.

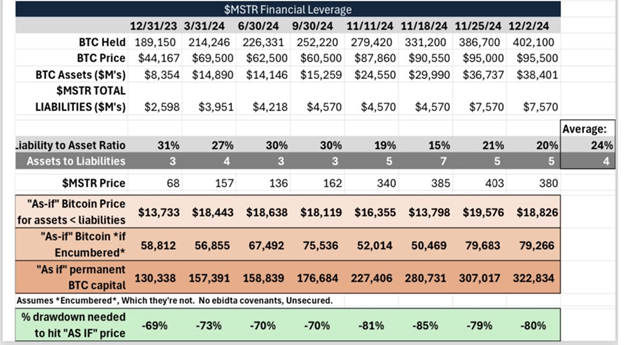

Bitcoin’s Fall Below $20,000 Unlikely to Significantly Impact MicroStrategy’s Bitcoin Treasury

New research from capital adviser Jeff Walton, shared on social media on December 3, suggests that even if Bitcoin’s price fell below $20,000, it would not be a significant shock to MicroStrategy’s Bitcoin treasury.

However, Walton says his business intelligence firm has invested heavily in Bitcoin and believes the company would survive an 80 percent plunge in the cryptocurrency’s value. However, MicroStrategy’s Bitcoin exposure continues to grow as the firm swoops up more billions of dollars in BTC.

Microstrategy’s experience shows that Bitcoin’s price can rise almost 40 percent in November before representing a significant risk for the company or its chairman, Mike Saylor, who has been behind building the company’s Bitcoin reserves.

Over the years, Bitcoin’s strategy on corporate balance sheets has been met by considerable criticism. A fundamental concern for Bitcoin’s volatility has been its 80% retracements in the past. Let’s look at, for example, how BTC/USD went from a $69,000 high to a $15,600 low between November 2021 and November 2022.

Walton says most of these challenges do not support strong logic and do not match the company’s track record with market downturns.

XRP Extends Poised Gains as Ripple Pumps 25% within 24 Hrs

On Monday, Ripple’s XRP surged 25%, sparking impressive month-to-date gains of over 430%. The remittance-focused token has also catapulted itself into the #3 position amongst top cryptocurrencies, despite a recent mixed sentiment pointing to bullish and mildly bearish moves.

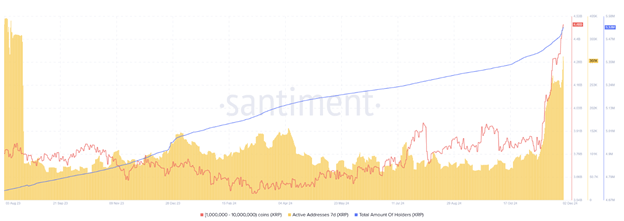

Santiment recently revealed the trends behind XRP’s performance. The token has seen an uptick in buying activity in the past three weeks.

The whale investors who own between 1 million and 10 million XRP have bought 679.1 million tokens, worth approximately $1.8 billion today. More importantly, the number of active XRP wallets also hit a new milestone total, surpassing 5.5 million for the first time since the token was launched.

Investor engagement has intensified on the XRP Ledger, too. The surge is almost 200 percent of weekly active addresses climbing to 307,000 in the past month. The increase in activity is the highest seen since August 2023, showing growing interest in the token as it surges.

XRP’s Bullish Momentum Reflected in U.S. Trading and Premium Trends

The Coinbase premium supported XRP’s bullish trajectory as U.S. traders were active. During November, data shows the XRP premium at the exchange fluctuated between 3% and 13%, suggesting strong demand. Upbit, which holds the largest XRP reserve, had a more moderate premium pace, showing a steadier premium level.

Regarding regulatory developments, assets manager WisdomTree witnessed a big move when it filed an S-1 registration statement with the U.S. Securities and Exchange Commission (SEC) for an XRP exchange-traded fund (ETF). This came after the company registered in Delaware last week. WisdomTree is the latest entrant to the XRP-linked investment products race, along with Bitwise, 21Shares, and Canary Capital.

Unconfirmed reports of New York government approval for a Ripple stablecoin have stirred social media platform X buzz as speculation continues. The rumor has been taken up by investment communities, many of whom believe it could intensify the ongoing XRP bull run even further.

The positive sentiment may not reflect what’s happened in recent markets, which have presented a mixed picture. Investors cashed over $2.7 billion in profits in XRP’s weekend price surge, the highest in eight years. The data shows whale investors’ enthusiasm, but it also shows many are cashing in on the rally to book gains.

Across all age cohorts, Mean Coin Age, a measure of investor accumulation and distribution trends, has been on a downward trend. This continuous slide over the past three weeks signals ongoing selling activity by short-term and long-term holders encompassing overall market trends.

As part of Ripple’s scheduled escrow system, the company just unlocked 500 million XRP tokens worth over $1.35 billion on Sunday. If this newly released supply hits the market immediately, market analysts warn that it could dampen XRP’s current bullish potential soon.

XRP Price Analysis

On Monday, Ripple’s XRP surged past the key $2.58 resistance level, causing $91 million in liquidations in the next 24 hours, according to Coinglass data. Significant market turbulence manifested in liquidated positions worth $38.67 million longs and $52.47 million in shorts.

Analysts say XRP will break out of its rounding bottom pattern if it can sustain above the $2.58 threshold before moving to $3.57. Last week this bullish structure when XRP topped out and advanced over the $1.96 level to cement that investor optimism.

XRP futures OI hit an all-time high of $4.24 billion on Monday, adding to the bullish sentiment. In an uptrend, when new capital comes in, the open interest of the derivatives market will generally increase because it indicates the total number of outstanding contracts in the market. It’s another great sign of growing trader confidence in XRP’s upside.

Still, optimistic notes sound despite a general caution penciled in technical indicators. This past week the Relative Strength Index (RSI) has been overbought and could be overcrowded with prices and prepared to correct.

If the weekly candlestick closes below the $1.96 level for one week, it will invalidate the bulls, reverse these recent gains, and dampen investor sentiment.