In the world of trading, it is not highly enough emphasized how much of this decision is based purely on human emotions and not hard, cold, apparently well-researched thinking, yet that is what makes money in trading.

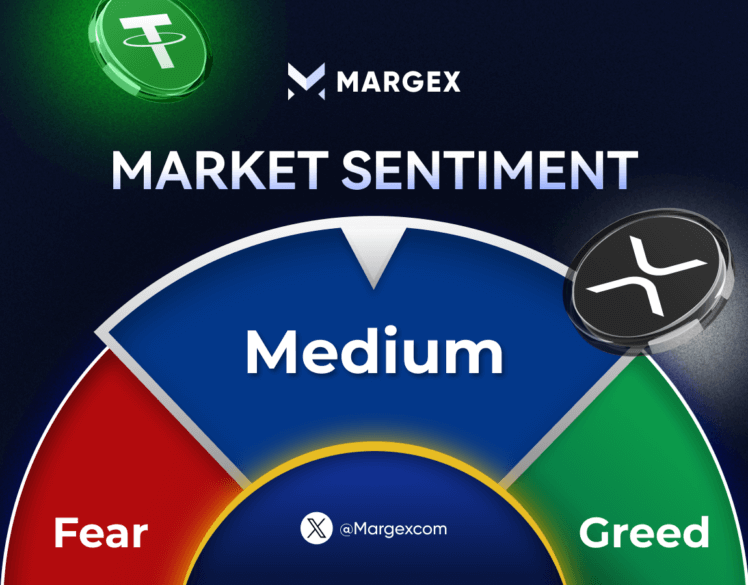

The Crypto Fear & Greed Index is much the same as the way market analysts gauge neuro signs to predict when bullish or bearish trends are more probable: it’s a metric used to determine the emotional health of cryptocurrency’s market.

This index is one that crypto traders consider a trustworthy tool to help them make an informed choice while trading. In this article, we dive deep into the workings of the Crypto Fear and Greed Index, what it means, and what it’s made of.

Exploring the Crypto Fear and Greed Index

The Crypto Fear and Greed Index was developed by Alternative.me and is a popular tool for gauging the mood of crypto sector investors. It uses data from multiple sources, such as volatility, market momentum, social media activity, and Bitcoin dominance, to generate a score between 0 (very fearful) and 100 (very greedy).

This score can help you see the risk factors for buying periods of high fear and the warning signals to not make rash decisions of great greed. Nevertheless, this index must be construed as just a part of a broader analysis and should not be relied on to enter or exist in a trade.

Understanding the Crypto Fear and Greed Index

In 1999, CNN Business division developed the Fear and Greed Index to identify traders sentiment within stock market and place it into the number one place of the stock market. This index highlights two primary emotions that influence trading decisions: fear and greed. This is a great concept because of its effectiveness and it was adapted to the cryptocurrency market.

The Fear and Greed Index tracks Bitcoin’s price in the crypto space, from extreme fear to extreme greed, hence it is extremely concentrated towards Bitcoin price.

This market sentiment indicator has a scale from 0–100. As the index gets close to 0, it indicates the highest fear condition; when traders are prepared to sell off their assets. A reading closer to 100, however, points to upside extreme greed, meaning traders are buying assets as Bitcoin prices rise.

During bull markets crypto traders generally suffer from ‘fear of missing out’ (FOMO), and buy digital assets without thinking as Bitcoin’s price rises. But once bought it is usually fleeting, market sentiment is bound to change.

If Bitcoin continues to rise in value it may be entering a crypo bubble that will see the asset become overvalued. If traders begin getting worried about a price correction now, there is also the fear that they will all of a sudden start dumping all of their holdings and this can be a reversal in market sentiment.

The Crypto Fear and Greed Index takes these emotional extremes and attempts to interpret them in order to help make sense of market reactions.

For savvy traders, when fear takes over, they tend to think this is a buying opportunity and they can buy assets at lower prices. On the other hand, if experienced traders are in a period of extreme greed, they will sell if they think they will be able to buy back into positions after prices have adjusted.

Key Components of the Crypto Fear and Greed Index

Market Volatility

Foremost among the indicators is the Crypto Fear and Greed Index, which is a product of market volatility and the often uncertain nature of the cryptocurrency market. This metric accounts for 25% of the fear index and estimates current price changes as compared to averages across the past 30 and 90 days.

These periods are often times that are marked with high volatility, and it means a leaning market toward fear, something that can certainly foster bearish trends. On the flip side, improved market sentiment across the crypto ecosystem usually results from stable price movements in these intervals.

Trading Volume and Market Momentum

Price trends over specific periods and market volume are incorporated as key indicators within market momentum. Increased trading volume means more trader activity with more greed, and less means less attention with less greed.

This means that Crypto Fear and Greed Index metric is about 25 percent of the time calculated over a 30 to 90 day period.

Social Media Activity

Trading behaviors in the crypto market rely considerably on social media. For example, people on platforms such as X and Reddit share their advice and the engagement on these platforms gives an idea on whether the market is heading higher or down.

What it actually does is it monitors the frequency at which people mention or add to a hashtag like bitcoin, and compares that to historical averages as a measure of investigation. It can mean that discussions around Bitcoin engage highly meaning a possible green market. Influential figures and traders use social media as a way to influence sentiment, and even drive FOMO (Fear of Missing Out) among other traders.

One example is a ‘pump and dump’ strategy where one party promotes an asset to create excitement and get other people to buy it which it’s later sold off and the rest are left holding worthless ones. About 15 percent of the Crypto Fear and Greed Index is made up of social media factors.

Market Sentiment Surveys

For example, surveys are used to measure broader market sentiment as measured by crypto. About 15% of the Crypto Fear and Greed Index is made up of this metric, and they generally update it weekly.

These are largely general market outlook surveys with participation of 2,000 to 3,000 people. A positive survey response can further a bullish sentiment course in the market.

Bitcoin Dominance

The Crypto Fear and Greed Index is active around the leader of digital assets: Bitcoin. A market session of high Bitcoin dominance can suggest that the market environment is fearful, and might deter would-be players from joining.

This is because Bitcoin is the asset inside the crypto house. Thus, if BTC’s dominance is rising, it can indicate that the market is adapting to risk.

When it comes to altcoins, traders are very greedy as they seek higher returns and love to allocate their funds according to greed levels. This dynamic is characterized by decreasing Bitcoin dominance. Also, less than 10% of Crypto Fear and Greed come from Bitcoin’s dominance.

Google Search Trends

Search interest estimates from publicly available data at a national level, reflect the relative level of interest in an area or topic and are not included to suggest bias. As searches for Bitcoin and other cryptocurrencies increase, the Crypto Fear and Greed Index can trend to extreme greed.

To continue using this analogy, if there is an increase of searches about “how do I buy Bitcoin”, the crypto market can have a rally. Instead, an uptick in searches regarding “how to short Bitcoin” could lead to pricing declines. Consisting of about 10% of the index, Google search trends make up the remaining 10%.

Advantages and Limitations of the Crypto Fear and Greed Index

When used in conjunction with comprehensive research and a good understanding of technical analysis, the Crypto Fear and Greed Index can be a great asset to your trading arsenal.

One of its benefits is that it provides traders with a picture of prevailing market sentiment, which better informs trading decisions. If you know what the other guys are thinking, then you can act contrarianly and take advantage of the market reaction resulting from excessive fear or greed.

Furthermore, the index is also promoting a diligent approach to traders who consider these factors in making decisions. This grants them the opportunity to observe and follow market trends during specified times that assist them in keeping the market in line with the larger sentiment.

Certainly, for newbies in crypto trading, the index is also a practical tool for grasping market psychology so that sentiment trends can be more easily identified without a lot of market knowledge.

As a user-friendly indicator based on clearly defined components, the Crypto Fear and Greed Index helps to identify a market’s emotional trend. It should not be relied on entirely, but the index can indicate as to where to take undervalued rides and when to be wary in an overoptimistic environment.

Drawbacks of the Crypto Fear and Greed Index

However, traders have pointed out that the Crypto Fear and Greed Index is limited.

The one downside is that it is not applicable to the crypto market’s long-term cycles. Long-term bull and bear phases typically consist of reoccurring Fear and Greed cycles, thus occasionally taking the index outside the main cycles. Conflicting signals may not benefit traders who look from a longer-term perspective.

Another obvious limitation is that the index relies on Bitcoin and often doesn’t even look at the top altcoins or the top sectors in the crypto market. Ethereum, along with other major projects or new emerging altcoin sectors, may not be equally reflected, leaving the index vulnerable as a complete market gauge.

Finally, the index doesn’t incorporate changes in the market after Bitcoin halving events, which typically preceded bullish runs. Without this, it can miss out on price growth after halving. When combined with the index, traders can consider these historical price patterns more robustly.

Assessing the Reliability of the Crypto Fear and Greed Index

The Crypto Fear and Greed Index is neither a good nor a bad tool—it’s carved out a niche by considering its advantages and disadvantages. It should not be used as a last resort when making cryptocurrency trading decisions.

It effectively captures market sentiment, but this index is largely focused on short-term sentiment and not everything that goes into the crypto market. Traders should use it to make their decisions, but rather than going by the index alone, these decisions should be based on thorough research and analysis.

In addition, traders should consider what they want to achieve as animescape with the incorporation of this tool into their strategies. Long-term outlook types may choose to concentrate more on the primary analysis of assets instead of valuing them in a feeling-driven signifier such as the Crypto Fear and Greed Index.

Conclusion

The Crypto Fear and Greed Index is an important metric that illustrates our current market sentiments and gives us an indication of the emotional drivers of fear and greed that drive crypto price movements. Given that it’s most useful for swing traders hunting for short-term trends, this makes it a prized possession.

However, it is instrumental in providing short-term, yet limited, applicability for long-term forecasting. It gives clues as to whether the market is bullish or bearish at any point in time, but it should be considered one of a range of tools to form a complete trading strategy rather than the determining factor.

If you’re interested in exploring more ways to understand where the market is at, we have more posts to read. If you want to level up your research toolkit, here’s our guide to the Understanding Support and Resistance Levels: Key Tools for Technical Analysis

FAQs

1. What is the Crypto Fear and Greed Index?

Crypto Fear and Greed Index is a tool that checks out the sentiment of the cryptocurrency market’s investors. It gives you a number between 0 and 100 that signifies aversion to fear or greed.

2. Who calculates the Crypto Fear and Greed Index?

The index is calculated from a group of components ranging from market volatility, momentum, social media activity, market sentiment surveys, Bitcoin dominance, and Google search trends.

3. What do the Crypto Fear and Greed Index scores mean?

Extreme fear is scored by a closer to 0 and extreme greed is scored by a closer to 100. On the other hand, high fear may indicate the buying opportunity, and exceedingly greed — the overvaluation and signaled market correction.

4. Is the Crypto Fear and Greed Index reliable for trading decisions?

The crypto fear and greed index does give us some insight into market sentiment, but we shouldn’t rely purely on it.

5. How often is the Crypto Fear and Greed Index updated?

Providing real time sentiment data for traders, we update the Crypto Fear and Greed Index daily. This provides instant market emotions insight that allows for market shifts to be timed.

6. Why is Bitcoin dominance important in the Crypto Fear and Greed Index?

Bitcoin dominance also plays an important part in the index as Bitcoin is thought of as the crypto ‘safe haven’ asset. If the market is fearful, high Bitcoin dominance is indicative. Lower dominance, however, with more interest in altcoins, shows the market is greedy.

7. What role does social media play in the Crypto Fear and Greed Index?

Market sentiment is shaped in large part by social media activity, including much of what goes on platforms like X and Reddit. The talk of Bitcoin tends to reflect the sentiment in general market engagement, a generally bullish signal if the bitcoin community is engaged in increased activity or a fear signal if a price correction discussion tends to be on the lips of community members.

8. How can traders use the Crypto Fear and Greed Index effectively?

The Crypto Fear and Greed Index should be used as an added tool by traders when deciding. There is a way however to do it and combining it with other analytical methods can provide traders with a more complete view into market trends and assist them in making more informed decisions using emotional sentiment and technical analysis.