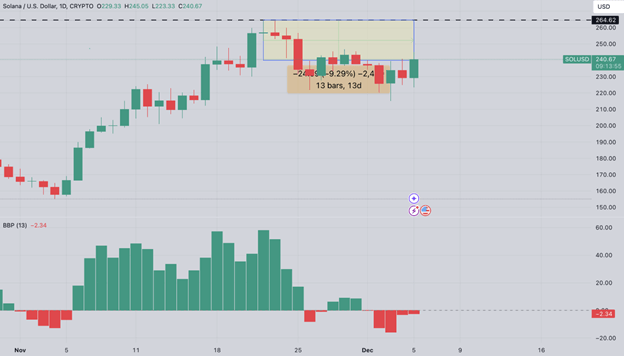

Last Thursday, Solana’s price decreased to $245, a 9% decline from a peak of $264 the previous week. Data on the Solana chain shows that key Solana stakeholders are still making money after Bitcoin’s historic break to the $100,000 mark.

Bitcoin Breakthrough Propels Altcoin Market Rally

Bitcoin has seen a breach of $100,000 for the first time as the winner of crypto-friendly Paul Atkins announced as nominee to replace Gary Gensler as U.S. Securities and Exchange Commission (SEC) Chair. President-elect Donald Trump’s decision, announced Wednesday, sparked optimism across cryptocurrency markets.

Bitcoin’s breakout sent Ripple (XRP), Ethereum, and Solana to fresh weekly highs from the ripple effect. After the Atkins announcement, Solana’s price rose 4.2% to $245, its highest-putting range since Tuesday, when it dipped to $224. But SOL’s rollercoaster ride failed to break beyond this resistance line, lagging behind Bitcoin, whose performance improved by 8% within the same 24 hours.

Solana’s relatively minor gains have ignited a debate about the market’s tendencies toward the bearish.

Investors Unstake $500 Million in SOL Post-All-Time High

Solana made global headlines last week when it hit a record high, reaching $264 on November 23 after not hitting a peak of $259 four years ago.

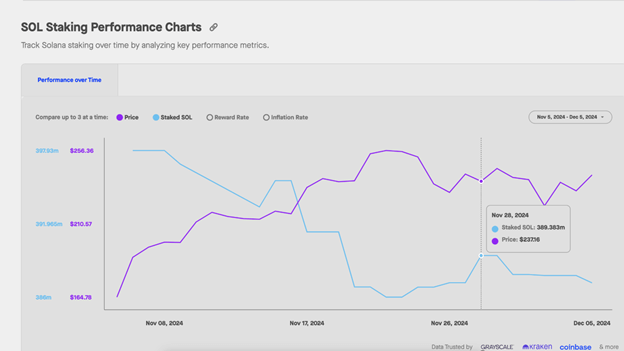

However, on-chain metrics show that many Solana stakeholders have taken advantage of the recent price surge. Data reveals a $500 million SOL withdrawal from staking smart contracts after an all-time high.

This activity is tracked on the chart of the total value of SOL staked in active smart contracts, which is often used as a proxy to track the movements of large stakers and core validators during key market events.

Furthermore, Solana’s lacklustre performance at $245 events as it attempts to oppose a profit-taking environment is a product of the confluence of profit-taking and broader market trends stemming from Bitcoin’s unprecedented rally.

| Day | Minimum Price | Average Price | Maximum Price |

|---|

Like Solana, network staking deposits have declined across the blockchain over the past week, perhaps warning of challenges for Solana’s price momentum ahead. Data from previous days, however, show that the total staked value tanked from 389.4 million SOL on November 28 to 387.2 million SOL on Thursday.

That amounts to more than 2.2 million SOL, or about $528 million worth at current prices, that Solana’s core network validators have withdrawn over seven days. Two key reasons are that such significant withdrawals during a market rally often dampen bullish sentiment.

The bullish sentiment from Bitcoin’s $100,000 milestone is diluted first through the withdrawal of 2.2 million SOL from staking contracts, which increases short-term market supply.

Stakers considered sophisticated investors responsible for keeping the blockchain safe, but they also hold quite a bit of weight in any proof-of-stake network. When this group makes large withdrawals, we often find that other market participants must be more motivated to engage in buying activity.

| Month | Minimum Price | Average Price | Maximum Price |

|---|

If staking outflows continue at this pace, Solana’s price may soon struggle to reach new all-time highs of $265.

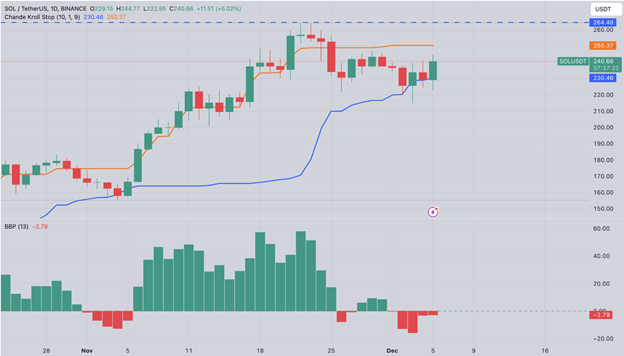

Solana Price Analysis: $250 Resistance Poses Challenge Amid Profit-Taking Trends

Headwinds include decreased profit taking on Solana and a steep decline in deposit staking, which puts downward pressure on Solana’s short-term price.

SOL will have a hard time overtaking a long-term critical resistance at $250 per token with the help of technical indicators like Chande Kroll Stop. Typically, this zone has been used as a selling trigger, and without its buying volume growing, the cryptocurrency could retrace further.

The BullBear Power (BBP) indicator is added to the Bearish momentum, which stays in negative territory. That reflects waning buying interest in the aftermath of recent efforts to hike prices, indicative of a percolating bearishness.

However, analysts warn that SOL might hit its next major support level at $230 if it cannot secure a daily close in the $245-$250 range. This potential downside points to the difficulty SOL may face in continuing this positive flow of money under the current screen conditions.

A breach below the $230 support could exacerbate selling pressure and push Solana (SOL) down to challenge the $224 support zone, where the cryptocurrency managed to find stability for a short time last week.

On the flip side, if SOL can close strongly above the $250 barrier, there is a chance for a clean breakout, leading SOL to new all-time highs beyond $270.

Although these are chances, Solana’s short-term direction remains neutral and heavily dependent on current market conditions. The past week has been marred by large-scale stakers departing over 2.2 million SOL, the leaders adding to the negative sentiment towards the asset’s near-term future.

Solana and Ethereum Carve Out Distinct Market Niches

Data suggests that Solana and Ethereum are living in harmony in different segments of the cryptocurrency environment. Solana (SOL) supposedly rivals Ethereum (ETH); however, recently released statistics have shown both networks’ ability to thrive independently.

According to DappRadar, Ethereum activity on the blockchain grew by 47% in the last month. In the same period, a leading decentralized exchange on Ethereum, Uniswap, saw its trading volumes go up by 62%, and CoW Swap reported a huge 71% increase.

Meanwhile, Solana has made a name for itself as a place for memecoin launches and trades, while Ethereum continues to be the platform of choice for decentralized finance (DeFi). Amazingly, most creators of three of the top five highest-earning DApps are hosted on Solana: Raydium, Jito and Pump. fun among other Ethereum’s frontrunners reach Lido, Uniswap, Aave, etc.

These blockchain networks have their strengths, but their paths to growth don’t have to be moving closer to the same user demographic.

But certain memecoins offer a degree of vulnerability with Solana. A significant amount of activity has been driven by the speculative mania of tokens like BONK, POPCAT, MEW, and SPX6900, and some of these have seen scores of 100% growth in as little as three months. And experts warn that such volatility might not be sustainable and could lead to network instability.

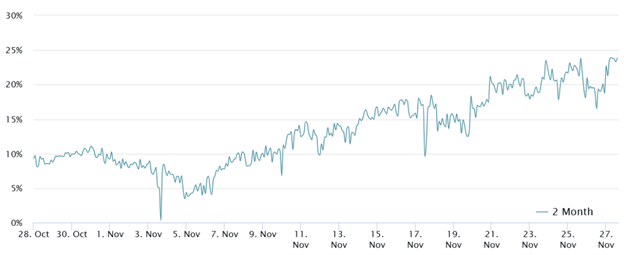

Futures premiums are a key metric for investors gauging SOL’s market sentiment, particularly as the token tumbled 10% between November 23 and November 27. Studies have revealed that in steady markets, monthly futures contracts trade 5 to 10% more than spot prices to account for the costs of settlement delays. These figures represent the traders’ confidence and prediction of Solana’s future.

SOL Futures Signal Strong Optimism

Data showed traders on Solana’s (SOL) futures market showing great confidence, with long positions drawing a 23% annual premium—its highest since July. This is very bullish for the SOL price. Still, analysts warn that exuberant bullishness for the coin can put this metric over 40%, magnifying the risk of liquidations cascading in the wrong direction due to an unexpected market correction.

Solana is likely due for a next inventory bounce as market data points to optimism on the asset. Looking at its on-chain activity and derivatives market trends, I suggest more price gains are coming up. At its current market capitalization of $113.7 billion, SOL is huge compared to Ethereum’s $429.4 billion valuation, but that $103.7 billion discount indicates a lot of room to grow.

This big valuation gap is needed because Solana facilitates rapid adoption in memecoin trading and high-performing decentralized applications. However, investors are asked to watch market conditions closely to keep speculative activity manageable and have opportunities amplified and risks.