Trading began on Tuesday with Bitcoin below $95,000, its lowest point since November 27. The information available on the blockchain reveals increased sell-side pressure from institutional investors heading into lower price levels below $90,000.

Bitcoin Struggles Despite Institutional Buys by MicroStrategy and Metaplanet

This article also shows that the cryptocurrency market reacted bearishly to comments made by the United States Federal Reserve Bank after the December 17 interest rate cut. Although several alts printed substantial gains over the weekend, Bitcoin dipped firmly into bearish territory.

However, the underperformance is realized after considerable purchases by institutional investors. On Monday, MicroStrategy informed its investors it had bought $516 million in BTC. That optimism is usually seen in BTC prices, which opened on Tuesday at $94,881, down 12.4% over the week.

Japan’s Metaplanet Inc. revealed a $58.9 million acquisition of 619.7 Bitcoin to this institutional action. However, even these very large acquisitions have not been enough to balance the selling pressure from other big players.

These major investments, though, have not helped Bitcoin turn around. Instead, it continues to fluctuate further to the bearish side. This might indicate that the market forces are much bigger than the institutional buyers. The question remains: could Bitcoin fall further, taking the $90,000 support level into consideration?

Bitcoin Whale Activity Hits Two-Year High Amid Market Downturn

In contrast to the correction that pushed the crypto market deep into November, large Bitcoin holders are as active as they were in early 2019. Holders of colossal institutional shares are readjusting their position after the Federal Reserve’s monetary policy forecast for Q1 2025.

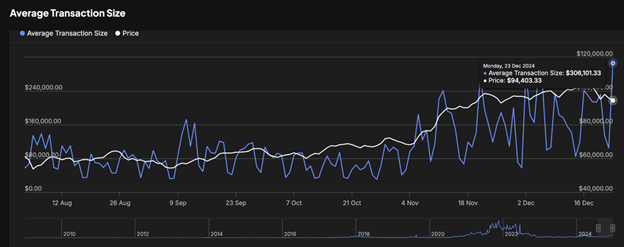

Last week, the BTC to USD ratio sank by 12%, and recent on-chain data trends indicate a marked uptick in whale transactions. The average transaction value increased to $306,100 on Monday, based on data compiled by analytics firm IntoTheBlock, the highest since November last year.

In the past, spikes in transaction sizes during these periods of low volumes have also been attributed to selling pressure by large holders or the ‘whales,’ which eventually put far greater pressure on the cryptocurrency market. This appears to be a dangerous trend that, if it persists, will prolong periods of bearishness, especially when large transactions are made, as they always bring about overall market feeling and liquidity.

This sell-off activity may set the pace for further sell-offs in the near term since it lacks an equivalent boost in demand.

Bitcoin Price Forecast: Key $90,000 Support Under Threat

The price of Bitcoin continues to attract attention as it tries to find its footing after the recent nosedive. On Monday, the BTC average transaction value increased to $306,111, a sign of whales and their large-scale dumps.

Today, Bitcoin is at $90,500, which is close to the lower border of the Donchian Channels, a key support level. Skeptics note that if Bitcoin drops below this level, it will lead to more selling, with the next main floor at $88,000.

Market behavior shows that constant attention should be paid to whale flows, as large transactions can significantly affect market movements. If the selling spree persists, especially at the same rate, without adequate buying power to offset the selling pressure, the digital currency may face more troubles in its bid to regain lost ground.

Bearish Momentum Persists as Bitcoin Struggles to Rebound

This bearish sentiment for Bitcoin has continued to gain roots, especially following the analysis of the Bull Bear Power (BBP) indicator that has been in negative territory for six days. This negative trend has persisted over an extended period, making it difficult for Bitcoin to attempt a reversal.

On-the-spot resistance is provided at $99,426 along the middle of the Donchian Channels. The current first resistance of purchasing is at $103,000, while the second and more crucial pattern, which would indicate the start of an upward streak, would be breaking above this range to the upside.

The future of Bitcoin is pretty much dependent on how it behaves around the key $90,500 support area. A break below this level could reaffirm bearish claims and thus push the market to a selling frenzy. Thus, if the price goes up and breaks above $99,426 continuously, one cannot speak of the current downtrend, which can lead to recovery and bring back spirits.

Ethereum ETFs Record Major Inflows Amid Bitcoin ETF Outflows

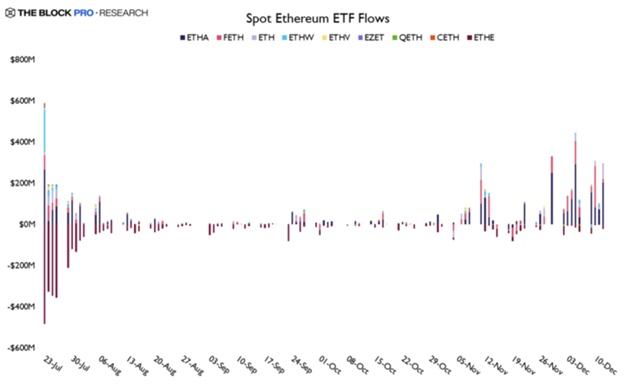

Last Monday, spot ETFs Ethereum saw record inflows, while spot Bitcoin ETFs saw outflows yet again, illustrating dwindling institutional demand.

Looking at the figures from Farside Investors, we can learn that Ethereum ETFs attracted $130.8 million of institutional funds on Monday, while spot Bitcoin ETFs lost $226.5 million. This represents the third outflow in the last three weeks for Bitcoin ETFs just as Bitcoin’s price plunged.

The situation with the Ethereum ETFs has improved throughout the past few weeks because of several positive fundamentals. The United States Securities and Exchange Commission (SEC) recently approved the first Bitcoin-Ethereum ETF, increasing the institutional demand for Ethereum or ETH. Market participants are also still optimistic about expectations of Ether ETFs’ reflected staking benefits, which will boost the product in question even more.

EY and data from IntoTheBlock show that ETF inflows look to have spiked in December. So far, the introduction of Ethereum ETFs has seen providers report $1.66 billion in fresh money on the 23rd of December, making it 74% of the $2.24 billion that has flown into Ethereum ETFs since inception.

Among the providers, BlackRock’s iShares Ethereum Trust was the market winner with single-day inflows of $292M on December 5. Many ETF providers received a much lower distribution of inflows, and among all the attendees of the ETF universe, Fidelity’s FETH is ranked second most popular.

This shift demonstrates institutional understanding in investing in Ethereum-based products as Bitcoin ETFs stall.

Bitcoin is in a choppy festive season as the fourth-quarter profits remain relatively steady at around 53%. Even so, this relief left its price over 10% below its record high of $108,353.

Ethereum vs. Bitcoin: Price Trends and Market Expectations

According to Coinglass, both Bitcoin and Ethereum futures markets are bullish. Based on the Tuesday report, the length/short span ratio in most derivatives marketing centers points to more than 1 for both resources regarding their near-future price trends.

Fundamental analysis from published Bitcoin and Ethereum price charts shows that cryptocurrencies may resume an upward trend aftermarket adjustments. Ethereum is currently hovering around $3,400 as of December 24, whereas Bitcoin is in the process of breaking past the leading resistance level at $99k towards $100k.

The last price changes nicely show that both currencies and tokens continue to demonstrate certain strength in the crypto market despite fluctuations.

Bitcoin Leads Christmas Eve Crypto Rally, Altcoins Take Center Stage

Overall, the cryptocurrency market rose by 5% on Tuesday as important assets sought to cut their losses from the week before. Altcoins are now shaping this trend, which could mean that bull sentiments are driving a ‘Santa rally.’

For Christmas Eve, the rest of the crypto market stabilized or found a way to recover after the recent slump. Top digital assets, including Bitcoin, Ethereum, Solana, XRP, and Dogecoin, posted handsome gains on the week owing to continued purchase flows from holiday traders. The bounce has raised questions about whether the market is in the much-anticipated Santa rally, a condition where stocks rally from the last trading period of the year to the early weeks of the new year.

Judging from the price movements on Tuesday, holiday traders have embraced this trend, buoyed by the notion that the memory of the market strength to be witnessed after the holiday period will be vivid. This optimism comes ahead of Donald Trump’s inauguration as US President on January 20, which certain market participants expect to ignite a major breakout.

Using the data collected in Coinglass, information concerning the changing investor positioning in the sphere of cryptocurrencies was obtained. On Monday, Ethereum ETFs saw $130.8 million in inflows, in stark contrast to the $226.5 million in outflows from bitcoin ETFs. This divergence points to increasing investor attention toward altcoins during the time of year when many are home with their families celebrating.

The effects of this shift are reflected by substantial double-digit increases in alts such as Pudgy Penguins (PENGU), Hedera (HBAR), JasmyCoin (JASMY), and Stellar (XLM). These have surpassed the larger assets, indicating increased trading in the altcoins market.

This trend replicates what began in the conventional stock market, in which people have taken advantage of the so-called Santa rally and caused equity prices to go up. There is enthusiasm in the market as traders put their bets as they prepare for what they hope will be a bullish year in assets such as cryptos and stocks.