MicroStrategy executive chairman Michael Saylor has also predicted that Bitcoin will spike to $100,000 by the end of 2024.

Given other high-profile developments in the cryptocurrency sector, such as recent price surges, MicroStrategy acquiring vast amounts of Bitcoin, and the impact of Donald Trump’s re-election on the crypto industry, this forecast is right on time. In the next section, this article explores these factors, introducing readers to Bitcoin as it currently exists and what the future may hold.

The thought of a Republican resurgence in U.S. politics has made Bitcoin advocate Michael Saylor even more bullish about his stance on the cryptocurrency. Even the software mogul and firm believer in Bitcoin is planning a party when the digital asset hits $100,000—a goal he believes will be reached by year’s end.

Billionaire Saylor, who founded public company MicroStrategy, which holds the largest public company bitcoin treasury, was optimistic in an interview with CNBC on Thursday. He claimed confidently that Bitcoin would breach the long anticipated $100,000 mark by December.

However, crypto experienced massive value after Donald Trump’s November 5 election as President-elect. Trump, known as a crypto-friendly president, promised support for the digital asset industry during his campaign and is primed to follow those promises.

Bitcoin Soars to $88,360 After Peaking at $93,477

As of Friday, Bitcon’s price stands at $88,360, following a run up to a record high of $93,477 two days earlier. This remarkable feat represents another $19,997 more than the last record, which was upended on Election Day.

Bitcoin advocate and executive chairman of MicroStrategy, Michael Saylor, viewed Trump’s election as a turning point for the cryptocurrency space. He said the development has been ‘incredibly auspicious for Bitcoin and the broader digital asset industry.’

While the evolving cryptocurrency sector has welcomed Trump’s return to the White House, Wall Street has also welcomed Trump’s return. The Securities and Exchange Commission (SEC) has targeted U.S.-based crypto companies for years, claiming they sell unregistered securities.

But Trump then performed a sharp about-face, becoming a high voice in the Bitcoin chorus. Within his pro-crypto approach, he vowed to rewrite leadership at the SEC by booting Chair Gary Gensler, a view that has earned him criticism due to his strict crypto regulation stance. Trump’s reverse stance on digital assets contrasts his previous skepticism about them.

Data analytics firm MicroStrategy invested heavily in Bitcoin in 2020. ‘The largest cryptocurrency by market capitalization, Bitcoin is the ultimate long-term investment,’ said Saylor, who co-founded the company.

In addition to recent market dynamics, which have certainly heightened Bitcoin’s importance in financial markets and politics as we know it, Trump’s evolving crypto-friendly stance speaks volumes.

MicroStrategy has cemented itself as a Bitcoin proxy and a vehicle for investors to gain exposure to the leading cryptocurrency via company shares. The firm’s strategy is bold: buy lots of Bitcoin, sometimes referred to as digital gold, with the hope of returning at some point. In recent months, the company announced grand ambitions to accumulate an additional $42 billion in Bitcoin over the next three years.

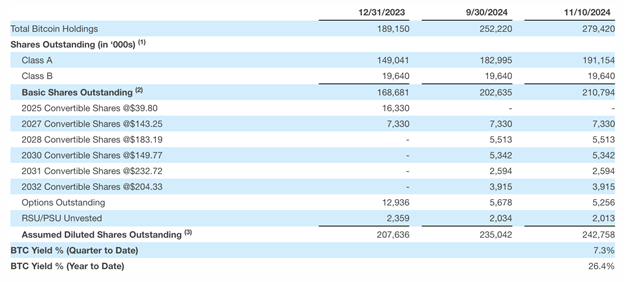

MicroStrategy, headquartered in Tyson, Virginia, currently owns 279,420 Bitcoin and is worth some $25 billion based on today’s prices. If Bitcoin rose to $100 per coin, as it did, for example, in January earlier this year, the value of its crypto reserves would be an estimated $28 billion—the scale of its bet on the cryptocurrency.

MicroStrategy $2 Billion Bitcoin Acquisition

Breaking news from MicroStrategy Inc.: It has done the rounds with a stunning Bitcoin acquisition totaling about 27,200 Bitcoin for $2.03 billion. This is the largest purchase made so far by the US conglomerate following its initiative to create a digital asset strategy back in 2018. In a statement made on Monday, the enterprise software company acknowledged the purchase, which took place between October 31 and November 10.

This is the company’s biggest buy since it placed an order for 29,000 Bitcoin in December 2020. According to the firm’s long-term strategy of Bitcoin investments and corporate approach, the move is in line with plans from co-founder and Chairman Michael Saylor. The hedge against inflation drove Saylor’s decision in 2020 to invest in Bitcoin.

MicroStrategy initially funded Bitcoin purchases with cash before diversifying its funding strategy. Now, the firm captures its buying power by selling stock, making marketable securities, and offering convertible debt. This approach has not only helped bolster the company’s Bitcoin holdings but also played a major role in its market performance in general.

MicroStrategy’s strategy and Bitcoin’s price run-up have helped it outperform other US equities like Nvidia Corp., an AI market leader. Over the same period, MicroStrategy’s shares have risen around 2,500%, while Bitcoin has increased about 660%.

MicroStrategy’s purchase of yet another Bitcoin brings its digital currency holdings to $24 billion, based on Bitcoin’s record-breaking price of more than $86,500 as of Monday. Regarding institutional ownership, despite having the largest publicly traded corporate firm as its holder, BlackRock’s U.S. exchange-traded fund now ranks as the second most prominent institutional owner.

Positive sentiments have further fueled the rally in Bitcoin. The uncertainty surrounding the asset class is coming to an end, and United States President-elect Donald Trump is saying that he would be ‘great’ with it.

Bitcoin Eyes $100K Milestone and Beyond: Analysts Weigh In

Bitcoin rocketed past a new all-time high of $93,434 just two days ago, which has boosted market sentiment once again. Investors are excited to see if the coin will reach $100,000 or better before the end of the year.

However, the birth of a crypto-friendly administration under Donald Trump has further boosted market participants’ confidence in Bitcoin’s history. This has created a supportive political climate for the flagship cryptocurrency, with some analysts even projecting a meteoric rise of up to $100K and beyond.

“When President Trump is inaugurated early next year, we think that Bitcoin will be priced at $180,000,” said Matthew Siegel, head of Digital Asset Research at global investment management firm Van Eck, who told CNBC he was bullish on Bitcoin.

Still, as the market sees the same developments, it seems more likely that Bitcoin is approaching a six-figure valuation as customers and others await the next breakthrough.

As part of his ongoing efforts to shape the regulatory landscape for Bitcoin and the broader cryptocurrency industry, former President Donald Trump is reportedly evaluating pro-crypto candidates for top positions at two key U.S. regulatory agencies: the Securities and Exchange Commission and the Commodity Futures Trading Commission.

Trump’s Win Effect on Crypto

However, Donald Trump’s re-election as President of the United States has already sent ripples through the cryptocurrency market, with Bitcoin and other digital assets concurrently developing. But experts say the most important effects may still be coming.

When Trump returned to the Oval Office for a second term on Nov. 13, Bitcoin plunged to a record $93,434. Several altcoins also posted significant gains in the rally, which wasn’t limited to Bitcoin. At the same time, cryptocurrency stocks increased as trading volumes for Bitcoin ETFs spiked.

As the cryptocurrency industry grudgingly became the darling of a sitting U.S. president, market analysts are factoring in the effects Trump’s policies could have in the months to come. Will this signal a new era of growth and mass acceptance of the digital asset space? However, more will be shown in the coming weeks as Trump’s leadership defines the cryptosphere.

Bitcoin’s recent price movements, characterized by greater volatility and growth, represent a turning point of greater institutional adoption, with favorable macroeconomic features supporting the cryptocurrency’s rise.

Conclusion

MicroStrategy is a major player in the crypto space. Despite being a large player in crypto, MicroStrategy has publicly stated that it has not sold its crypto holdings. This ongoing investment is a vote of confidence in Bitcoin’s future, cementing the bullish sentiment of the digital asset.

The crypto market outlook has improved with Donald Trump’s potential re-election. Given these factors, market watchers anticipate the impending year will impact Bitcoin’s direction.

However, the challenges and uncertainty have not prevented the bullishness for Bitcoin as the current market and vector have indicated the possibility of reaching $100,000. With the crypto industry evolving thus far, investors are watching keenly to see how such developments will play out in the months ahead.