Crypto Price Outlook: Bitcoin Holds $100K, Ethereum Targets $4,093, and Dogecoin Traders Invest $1.2B Amid Macron-Musk Talks

BTC still recorded a small decline on Tuesday, trading at a little over $101,300 after gaining an almost 4% increase on Monday. The rally that saw BTC cross the $100,000 mark came after the news on Monday of Michael S. Barr’s resignation from the Federal Reserve Vice Chair for Supervision.

The same report was prepared by Bitfinex, which pointed out that Bitcoin is still in a state of continuous strength but could experience a market-depth downtrend in the first quarter of 2025.

On Monday, the cryptocurrency reached well above $102,000 once the Federal Reserve Board announced that Barr had released most of his regulatory pursuits. This action has been précised to exert a positive impact on the crypto market, as Barr used to scrutinize the banks that interact with cryptocurrencies strictly. Some observers believe his exit might ease concerns about a crackdown on new regulations in President Biden’s last two years.

The latest weekly report, Bitfinex Alpha 2025, released on Monday, indicates that Bitcoin is still strong despite the possibility of an early-year correction.

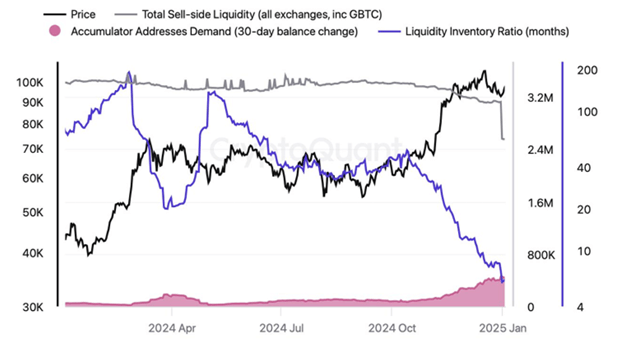

Other considerations from the report included that Bitcoin seemed to have experienced a sharp deterioration in sell-side liquidity. The Liquidity Inventory Ratio, a measure of how long the currently available supply can feed demand, plummeted, data included in the report show. It declined from 41 months to 6.6 months in January, showing that the market was getting forward from earlier October.

This squeeze of the liquidity ratio is consistent with Bitcoin’s strident upsurge in the fourth quarter of 2024. The report also provided evidence that shrinking sell-side liquidity could be demand-driven as market activity increases and supply reduces during periods of bullish sentiment.

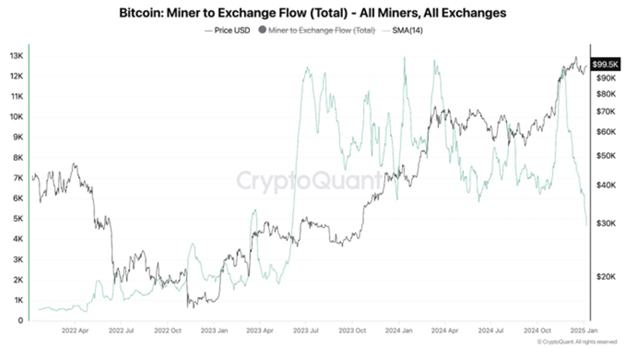

A recent report reveals the significant factors influencing the supply side of Bitcoin, which is highly correlated with mining updates. As per the data observations, after the Bitcoin Halving, which occurred in April 2024, miner sales usually help to purchase operational expenses sharply reduced. This has brought down the congestion of buyers by vendors, a trend that was noticed at the beginning of 2025 due to restricted supply.

Bitcoin Breaks $100K Mark Amid Bullish Indicators.

Bitcoin surpassed the key $100,000 on Monday, ending Tuesday at over $100,200. However, the cryptocurrency had pulled slightly lower by Tuesday and was in the $101,300 range at reporting time.

According to market analysts, keeping above the $100,000 level could lead to further growth; even re-tested the $108,353 per bitcoin set on December 17, 2024.

Technical Analysis Supports Uptrend

From technical analysis, the signal is equally bullish and supported by some technical characteristics. In its indicated status of greater bullish mentum, the Relative Strength Index (RSI) based on the daily chart is currently at 59, more than halfway to its midpoint of 50. Further still, on Sunday, the moving average convergence divergence (MACD) indicator signaled a bullish trend through a buy signal, which indicated a continuation of the trend.

However, the analysts warn that if the price falls below the green area, that is, below $100,000, then a lower trend will occur. In such a case, it may challenge a 38.2% Fibonacci retracement level at $92,493 from the November 4 low of $66,835 to the newly formed high of $108,353 on December 17.

Since market participants track price changes, the current Bitcoin levels are expected to determine its future in the upcoming weeks.

Ethereum Approaches Key Levels Amid Investor Accumulation Trends

Ethereum (ETH) was hovering near $3,700 on Monday, rising from last week’s investor accumulation rates. Further continuation of the accumulation may develop the inverted head-and-shoulders (H&S) pattern in ETH, which price may break the $4,093 resistance level upwards.

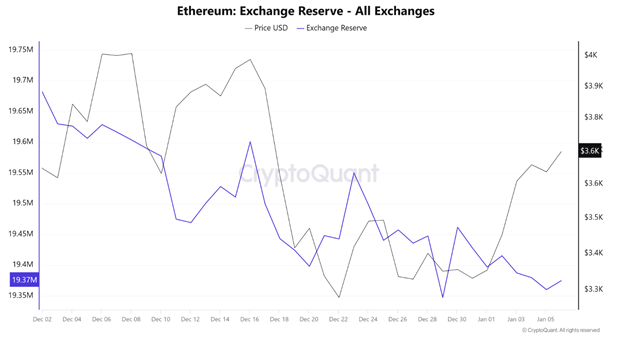

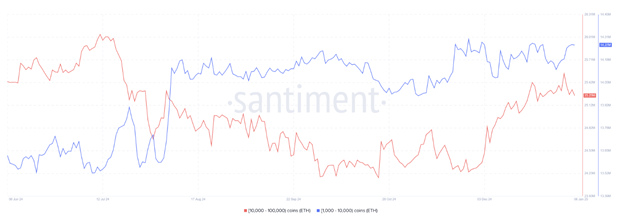

CryptoQuant data showed that ETH investors transferred more than 80,000 ETH, or about $300 million, of the asset to their personal wallets from exchanges last week. A similar trend was observed when investors became more confident about buying stocks in anticipation of a positive January, as observed in previous years, 2018 and 2019.

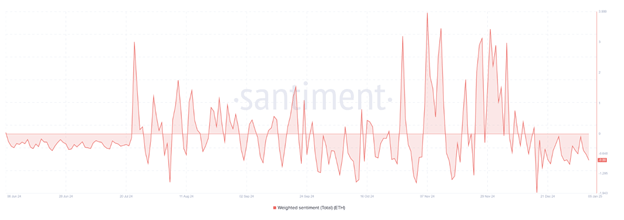

Slightly over half of the accumulation activity was derived from entities with between 1,000 and 10,000 ETH, while large whales with 10,000 to 100,000 ETH dumped their coins. However, there has been an increase in this accumulation while the Weighted Sentiment of ETH has been declining slightly, pulling the social sentiment indications to bearish. Santiment found such sentiment, especially before the price rises, because of the current rotational trend, where market movements go against the sentiment of retail investors.

Market analysts are also looking forward to the U.S. jobs figures due on Friday to possibly trigger Ethereum’s or the broader crypto’s 2025 price direction. On the other hand, products focusing on Ethereum outflow with $38.1 in net flows the previous week data retrieved from Coinglass.

In the trading session, Ether gained 2% in the last 24 hours, while the futures liquidations were recorded at $39,240,000. Of this, $10.79 million was for long positions, and $28.45 million was for short covering.

Technical Indicators Signal Potential Breakout

For Ethereum, an inverted H&S pattern is seen on the weekly chart when the price dipped in December, holding the 50-day SMA and bouncing back. The bullish outlook was boosted by the break above the $3,550 level the previous week. A break above the $4,093 level of neckline resistance, which has been in place since March, could take ETH to its prior yearly high of $4,868.

The RSI and Stochastic Oscillator (Stoch) are now above the midline, suggesting strong bullish pressure. Failure to reclaim and maintain a price above the $3,000 psychological level will debunk this bullish narrative.

Specifically, the existing sentiment will still play a central role, together with market sentiment, in determining Ethereum’s trends in the coming days as Ethereum approaches important price levels.

Dogecoin Consolidates Below $0.40 Amid Election Meddling Allegations Against Elon Musk

Dogecoin remained range-bound below $0.40 on Tuesday as traders responded to statements by French president Emmanuel Macron accusing the tech billionaire Elon Musk of using his X platform to influence Germany’s upcoming elections.

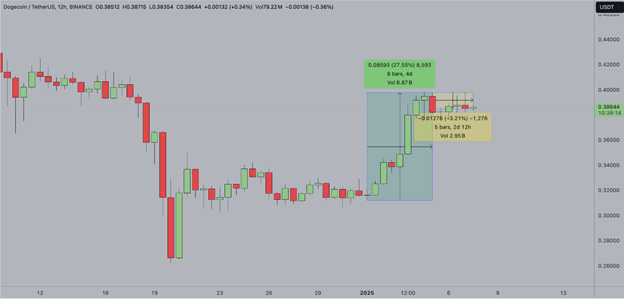

The present controversy has boosted a large volume of trading, with more than $1.2 billion of fresh Dogecoin positions established one day after this piece was published. As a result, market analysts are struggling to decide whether DOGE is ready to rally from $0.40 to $1 or pull back to $0.30.

Macron vs. Musk: Impact on Dogecoin

Macron’s ill-treatment of Musk has received massive coverage in the media, bringing more attention to Musk’s previous impact on Dogecoin. Due to volatility driven by the Tesla CEO’s tweets, traders have grown cautious about the next course of cryptocurrency.

The price of DOGE has remained between $0.35 and $0.40, which has depicted traders’ indecisiveness in the last three days. Such a limited price range with Musk tied in controversy has been a recipe for increased market oscillation.

According to Coinglass data, Dogecoin’s open interest surged, with active futures contracts going up from $2.89 billion on Sunday to $4.07 billion by Tuesday. Speculative activities are usually considered when identifying breakout phase indicators, hence the $1.18 billion increase in open interest.

It became significant to notice that directional movement during a consolidation phase rises, which indicates that traders are anticipating the price to move in a specific direction. Some market analysts consider this an imminent liquidity surge, with higher investor interest that can further push DOGE to new levels.

Catalysts for a Breakout

We can consider many factors that may affect the future performance of this cryptocurrency as Dogecoin. Should Elon Musk advance solid evidence to refute Macron’s claims, this might post-reset the focus on the contrapositive, which could further fuel a changed sentiment among the DOGE holders.

Also, there may be some support in the broader crypto market rally of its competitors and counterparts. Such positivity at Bitcoin’s crossing over $100,000 could help accelerate Dogecoin above $0.40 to signal higher ground.

A big catalyst for a shift seems inevitable for the Dogecoin traders observing these occurrences. The next few days are likely to determine whether DOGE will finally surge past $1 or experience a decline once again.

Dogecoin Surges 28% in Early 2025, Faces Resistance at $0.40

By the first five days of 2025, the price of DOGE marked a strong 28% to its value. Besides, the Dogecoin has yet to break above the $0.40 price mary fully.

Market interest came after a reported $1.18 billion purchase of DOGE for trading after Macron accused Elon Musk of manipulation. This is encouraging, as most traders believe the prices can return to half a dollar.

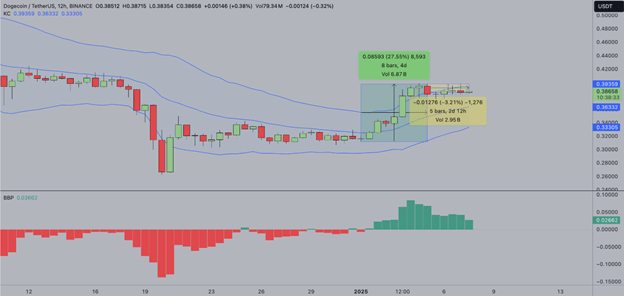

Dogecoin Price Analysis

Technical analysis goes hand in hand with this bullish view. Analyzing the DOGE/USD 1D chart, it is possible to conclude that the cryptocurrency remains in the upper Keltner Channel, which means it has much potential. Also, the Bull Bear Power indicator is still above the zero line, meaning that the side of buyers is gradually taking control.

More so, there are indications that if Dogecoin can manage to stay above the $0.41 price level, it would further create a breakout towards the $0.50 mark. But perhaps the most crucial is the $0.40 level tested during the recent bounce.” If traders continue their buying spree, other resistance levels are estimated at $0.45 and $0.50.

On the other hand, a break below this can crash to the $0.36 support level in tandem with the Keltner Channel’s midpoint. If $0.36 is pierced, the bears could force a steeper retracement down to $0.33, representing the base of the upward-sloping channel.

Market players focus on Dogecoin’s next move because a breakthrough of key resistance levels will determine the cryptocurrency’s further advancement in 2025.